Offshore in Switzerland: welcome to shell companies paradise

Zurich, Lausanne, October 6, 2021

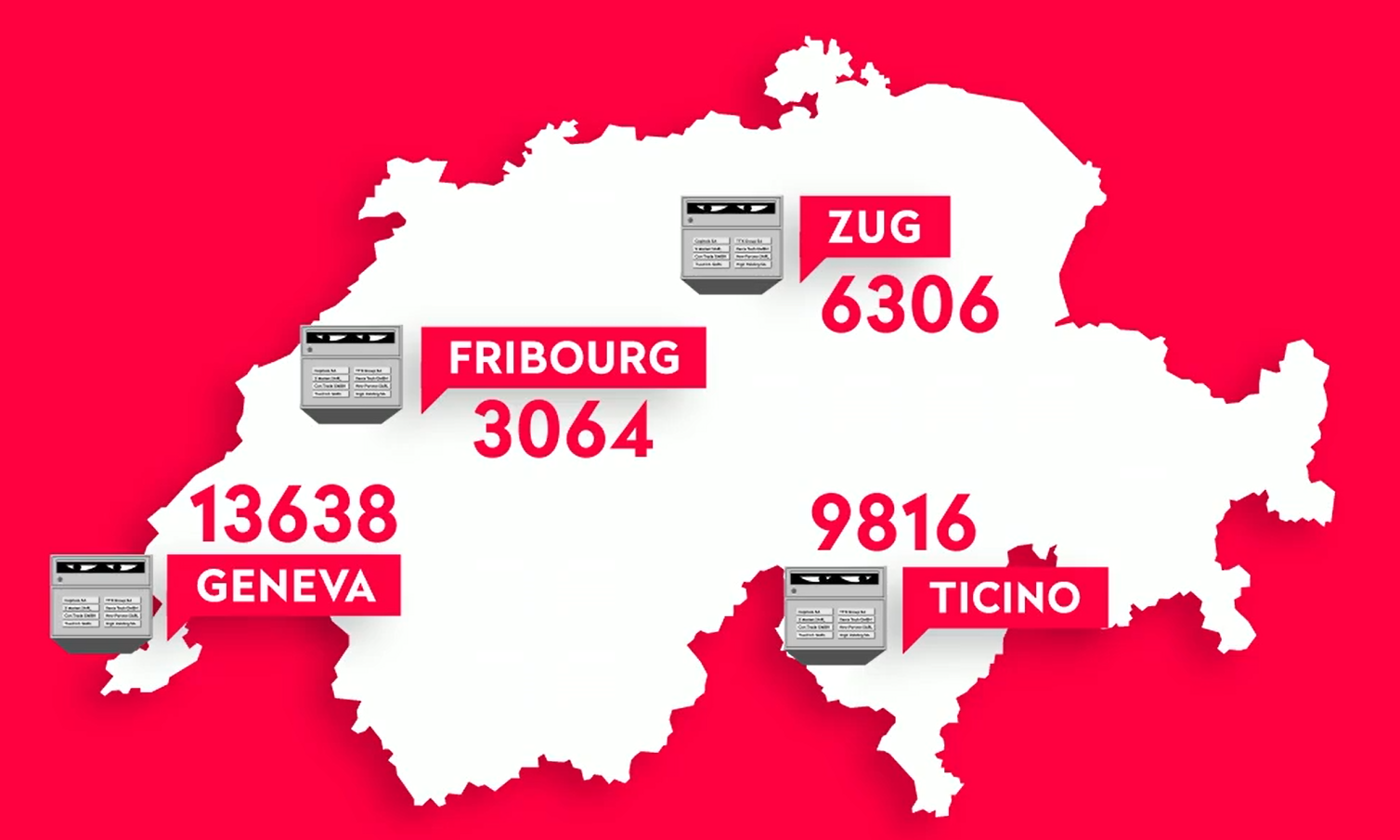

Geneva, Lugano, Zug and Fribourg: these are the cities that are home to the largest number of domiciliary companies and other holding companies in Switzerland, that is shell companies engaged in no commercial activity. The field is headed by the canton of Geneva, which has a total of 13,638 such companies, equivalent to a third of the companies entered in the official register. This is the situation highlighted by research conducted by Public Eye, which mapped the commercial structure of the four major domiciliation hubs in Switzerland. These shell companies are registered by the dozens in “ghost” buildings, where law firms and fiduciary offices administer their day-to-day affairs from a monthly cost of CHF 99, including telephone and concierge services for the sake of appearances. The majority of is operating in finance, real estate or commodity trading. A recent survey by the Federal Statistical Office confirms that one company in four operating in the commodity trading sector has no employees.

Domiciliary companies are not necessarily engaged in illegal activities. But this is the type of structure most often used when it comes to concealing shady transactions in Switzerland or hiding the ultimate beneficial owners. This was recently highlighted by the case of the Zug holding company Zeromax, which subsidised the lavish lifestyle of Gulnara Karimova, daughter of the former Uzbek dictator. According to the statistics from the Swiss authorities, almost half of the incidents reported to the Money Laundering Reporting Office Switzerland (MROS) involve domiciliary companies. And in almost 12% of these cases, the legal structures involved are registered in Switzerland. Corruption is one of the main suspected activities reported.

The Panama Papers haven’t prompted the parliament to plug the loopholes in the Swiss Money Laundering Act during its recent revision. Switzerland’s Federal Council also refuses to create a public register of the ultimate beneficial owners of companies, even though more than a hundred countries have committed to implementing this vital measure to combat the lack of financial transparency. To avoid a remake of the banking secrecy debacle, Switzerland must learn the lessons from the Pandora Papers and plug its legal loopholes which facilitate the global merry-go-round of tax evasion and white-collar crime.

For more information (and case studies by canton), click here or contact:

Oliver Classen, Spokesperson, oliver.classen@publiceye.ch, +41 44 277 79 06