Suspicions of Corruption in Guinea, Opacity in Geneva: the Steinmetz Group under pressure

Zurich/Berne, October 22, 2013

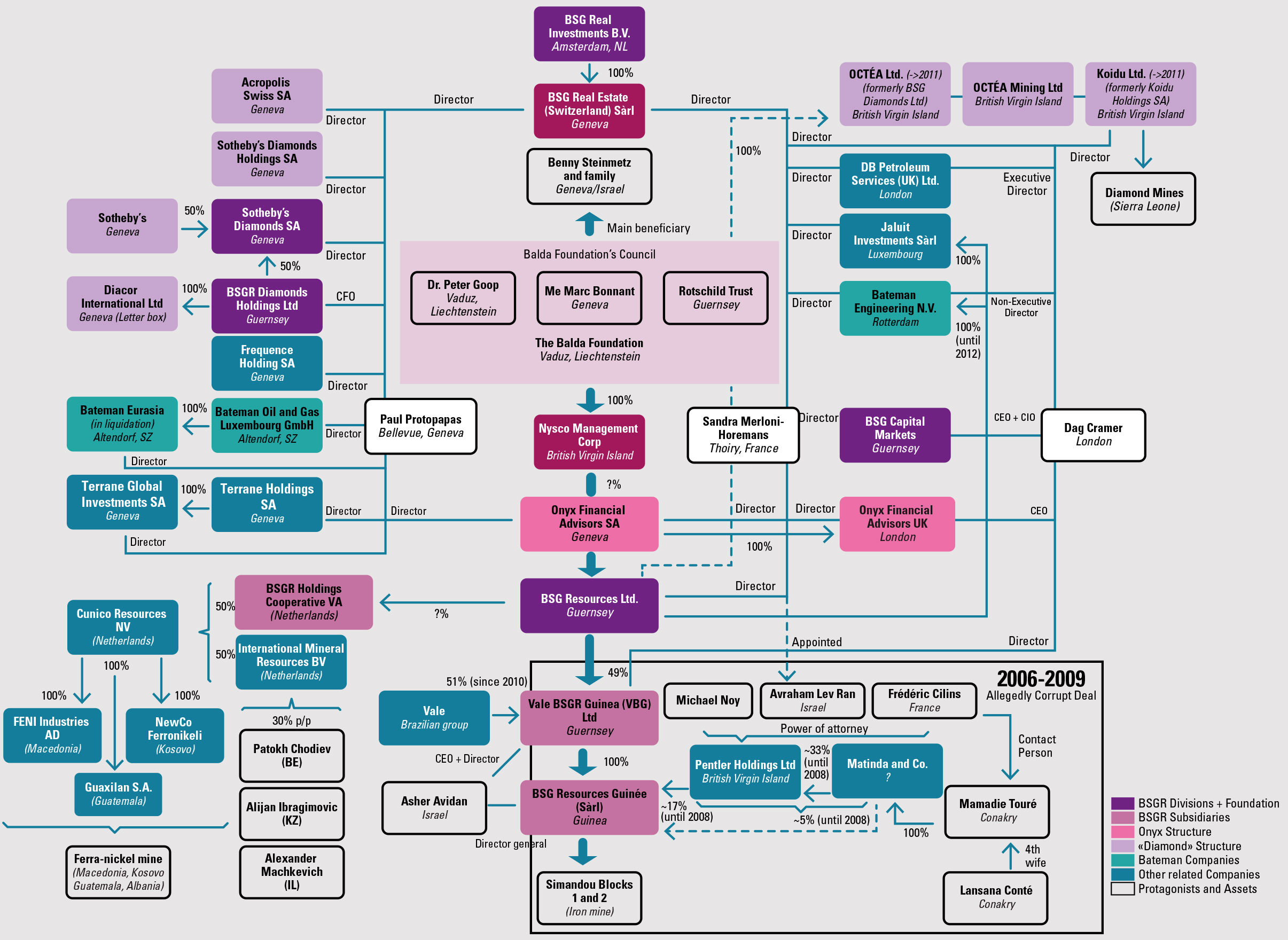

The organogram reconstructed by the BD demonstrates the extraordinary difficulties faced by judges when conducting enquiries into groups like BSG. Such a level of structural complexity is by no means unusual in the Swiss commodity trading industry, even if BSG does show itself to be particularly skilled in the art. If nothing else, the alleged case of corruption involving the attribution to BSG of half of the mining rights to the iron deposits in the Simandou mine has attracted legal intervention in no less than six countries, including Guinea, the United States, Switzerland, England, Guernsey and France. But operations are not only confined to these six: the group has entities in the British Virgin Islands, Liechtenstein, the Netherlands, and Cyprus, as well as in several other jurisdictions famed for their accommodating tax regimes and lack of transparency as to a company’s beneficial ownership and activities.

In Geneva, searches were carried out in August, notably in the offices of Onyx Financial Advisors, one of BSG’s most important arms and almost certainly its decision centre. This company is co-directed by Paul Protopapas, chief financial officer for the entire group, and Sandra Merloni-Horemans, loyal director for a good half-dozen entities linked to BSG, who has signature rights for each tentacle of the octopus, from Conakry to Guernsey and from Geneva to Amsterdam. It’s also along the lake shores that you find one of the councillors of the Balda Foundation, the ultimate vehicle for the redistribution of profits to the Steinmetz family: Geneva lawyer, Marc Bonnant, the billionaire’s friend of thirty years. And it’s also from Geneva, where Beny Steinmetz has been living since 2005, that BSG is controlled.

The BSG case is textbook, a perfect example of what happens when unscrupulous groups serve their own interests by realising enormous profits off the backs of some of the world’s poorest countries. It shows why transparency must be a requirement for all companies active in the commodity sector and underlines once more how important it is for Switzerland to keep in step with the international movement, already implemented in the United States and the European Union, which obliges companies to publish their payments to governments (licences, concessions, taxes, etc.). In any event, the BSG structure and the Guinean case show how the abusive use of tax havens enables the concealment of illegal activities, particularly corruption in fragile states, as well as tax evasion that causes direct damage to those states. In order to put an end to these practices, the owners and ultimate beneficial owners of the companies should be published in the Swiss commercial registers.

Further information available here or contact:Marc Guéniat, Berne Declaration, 021 620 03 02, gueniat(at)ladb.ch

Background

The diamond dealer Beny Steinmetz was scuppered by his enthusiasm for Guinea. In 2011, the first democratically elected president the country has ever known, Alpha Condé, initiated an investigation into the mining contracts concluded by his predecessors. It was this investigation, exemplary for its transparency, that led to the discovery of what the press have termed “the heist of the century”: in 2008, profiting from the last hours of the dictator Lansana Conté’s life, BSG obtained the concessions to Blocks 1 and 2 of the “fabulous” iron deposit Simandou mine.

For an initial investment of 165 million dollars, BSG resold 51% of its holding 18 months later to Brazilian Vale for… a staggering 2.5 billion dollars! In early 2013, a criminal investigation was opened in the United States. While the FBI were collecting documents and gathering witnesses, Beny Steinmetz denied the accusations. In an interview published on the 9 October by l’Opinion (a French-language daily newspaper), the diamond dealer accused President Condé of “leading a campaign of disinformation, intended to soil [his] reputation, that of [his] company and [his] name”.

For him, the story was “pure invention”. As revealed here by Médiapart (a French-language news website), on the 18 October, Beny Steinmetz went before the public prosecutor in Geneva. An investigation was then opened in Geneva – for the time being against “X…” – for “corruption of a public official”.

©

©