Trends and developments in the global agro-food sector

©

Yasuyoshi Chiba / AFP / GettyImages

©

Yasuyoshi Chiba / AFP / GettyImages

©

Diego Giudice / Bloomberg Getty Images

©

Diego Giudice / Bloomberg Getty Images

Overall, China, India, Brazil, and the USA are the world’s key agricultural producers. For specific crops, however, other countries and regions dominate the scene. The bulk of cocoa, for instance, is produced in the West African countries of Côte d’Ivoire and Ghana, while oil palm trees are predominantly cultivated in Indonesia and Malaysia. Looking at key agricultural commodities, wheat, corn, rice, and soybeans are by far the most important crops in terms of total acreage (between 120 and 220 million hectares each). The dominant role of corn and soybeans is explained by their “multiple and interchangeable uses as food, feed, fuel and industrial material”. For these commodities, including sugar cane and oil palms, the term “flex crops” has been coined.

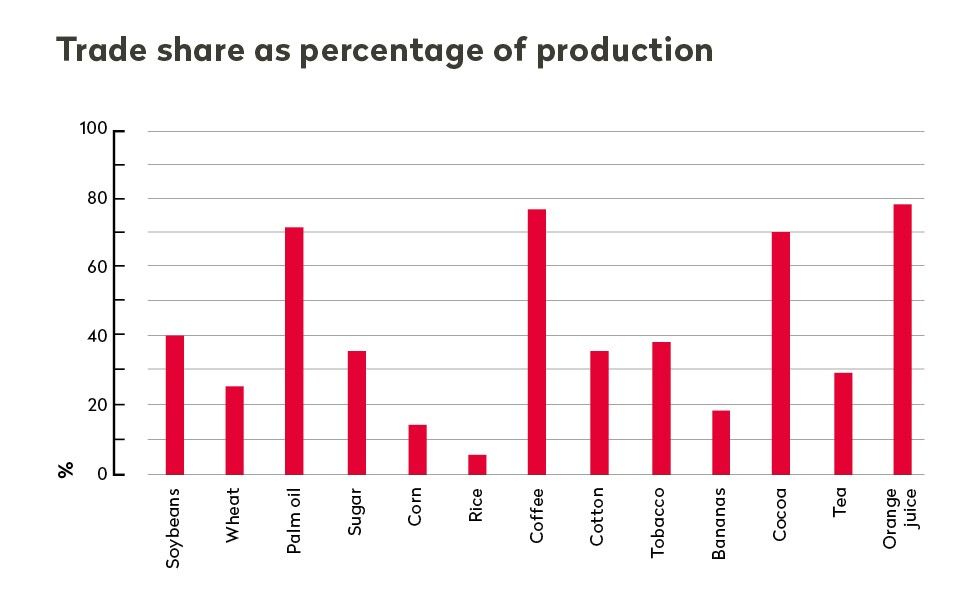

The internationally traded share of the most important agricultural goods is just a fraction of their global production, often below 50%. Over the past two decades, these trade shares have remained constant for key agricultural goods, with the exception of soybeans whose internationally traded share has risen by 20% according to the OECD.

In terms of value, the main agricultural commodities shipped around the world are (in decreasing order): soybeans, wheat, palm oil, corn, rice, coffee, sugar, tobacco, cotton, bananas, cocoa, tea, and orange juice. In 2020, the USA and Brazil accounted for 85% of soybean exports, while China alone purchased 63% of all exports. Similarly, over 85% of palm oil was exported by just two countries, Indonesia and Malaysia, with India and China importing almost 30% of the total. According to calculations based on the Trade Map database, highly concentrated trade can also be found in corn, cocoa, cotton, rice, coffee and tea, with three countries responsible for between half and two thirds of all global exports of these commodities.

How commodity trading works

Trade in agricultural commodities takes place in various forms of markets. On derivative markets, rights and obligations to trade a commodity in the future are exchanged. On spot markets, physical commodities are directly traded. The world's largest exchanges for agricultural commodities are located in the USA. In Europe, important commodity exchanges are in Amsterdam, London, Paris, and Frankfurt. Increasingly important exchanges are also found in the emerging markets.

Derivative markets provide a price discovery function for physical commodity traders as prices on futures markets are used as a benchmark for spot transactions. Furthermore, spot market participants can use derivative markets to hedge against the risk of price fluctuations. Commodity derivatives are also traded over-the-counter where two parties exchange derivatives on individual terms.

Financial investors such as banks, pension funds and hedge funds have become increasingly active in derivative markets. They are not interested in the physical goods, but only invest in commodities as an asset class. The strong rise of financial actors not intending to buy physical commodities is known as the financialisation of commodity markets.

On commodity spot markets, physical goods change ownership simultaneously with the conclusion of a contract i.e., goods are delivered with no or only a short delay. Because commodities are bulky and costly to transport, spot market transactions are usually geographically dispersed. They are often contractual arrangements between two actors who do business with each other, including producers, consumers, and traders of physical agricultural commodities.

Source: Staritz, C., B. Tröster and K. Küblböck (2015). Commodity Prices, Financial Markets and Development.

In terms of global production, the share of agricultural value added in world Gross Domestic Product (GDP) has continuously declined over the past years. However, the importance of the agricultural sector differs considerably at the national level. While in the least developed countries agriculture still contributes on average to over 20% of GDP, this figure is closer to 1% in high-income countries according to the World Bank.

©

Noel Celis / AFP Getty Images

©

Noel Celis / AFP Getty Images

A similar development can be observed in the area of employment. In low-income countries, on average two out of three jobholders are still found in agriculture compared to three out of one hundred in high-income countries. Accordingly, the International Labour Organization (ILO) calculates that

the vast majority of the almost 900 million people who work in agriculture worldwide are found in low-income countries.