40 to 90 percent! Astronomical profit margins of Pharma companies cause skyrocketing premiums

Zurich / Lausanne, September 12, 2022

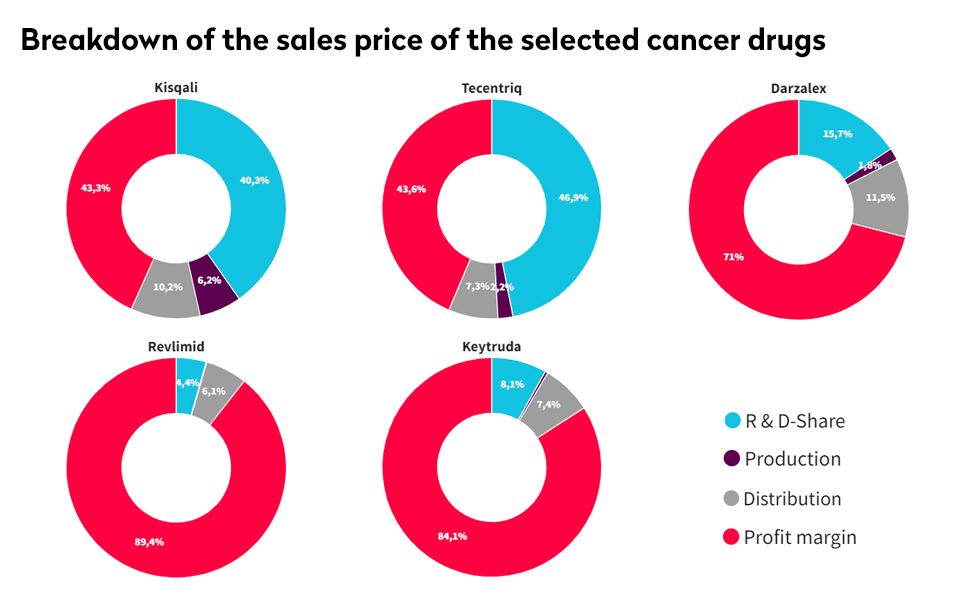

Novartis and Roche disclosed huge profits in the double-digit billions for 2021. The sector is thriving which is not just a result of the pandemic. For the first time, a new report by Public Eye calculates the profitability of particularly expensive cancer treatments and shows that they make profit margins of 40-90 percent, even when taking into consideration the commercial risk of failures in the research and development process(R&D). Even new drugs bring in exorbitant revenues– in the case of the breast cancer drug ‘Kisqali’, authorised in Switzerland since 2019, CHF 430 of the CHF 1000 paid by the health insurer goes straight onto Novartis’ balance sheet as net profit. And the longer a drug is on the market, the higher the profit margin. For Bristol Myers Squibb’s blood cancer drug ‘Revlimid’, reimbursed since 2008, the profit margin is an unbelievable 89 percent.

Patent protection on drugs should serve to incentivise the medical research and innovation associated with its development. In reality, the instrument creates monopolies, which grant pharmaceutical companies massive pricing power and allow them to make astronomical profits. The industry justifies its high prices with the argument that they compensate for the risk of failures of new drugs in the R&D process. At the same time, the sector refuses to disclose any information on actual investments. As a result, and notably since the 2019 WHO transparency resolution, stronger efforts have been made at the international level to, at long last gain more clarity around prices and real R&D investments.

But Switzerland’s government is moving in the opposite direction. In the context of cost-cutting measures which include a review of the Health Insurance Act, it is promoting questionable backroom deals and wants to weaken the Freedom of Information Act in a way that undermines the system. Confidential agreements do not help reducing prices – quite the opposite. What is needed is more transparency around pricing and research and development costs. Rationing and limiting which costs are reimbursed by the compulsory insurance is increasingly leading to two-tiered healthcare in Switzerland. Globally, two billion people lack access to essential medicines due to ever increasing prices.

For more information contact:

Oliver Classen, Spokesperson, 044 277 79 06, oliver.classen@publiceye.ch

Gabriela Hertig, Health policy expert, 044 277 79 91, gabriela.hertig@publiceye.ch

*****************************

Study methodology:

Based on estimates of the research and development (R&D) costs for six cancer treatments by Novartis, Roche, Johnson & Johnson, Bristol Myers Squibb and MSD Merck Sharp & Dohme, Public Eye calculated the profit margins of those individual medicines in Switzerland. The basis were the costs of the global industry-funded clinical trials undertaken for each drug, as these constitute the largest R&D cost item for the companies. Additional costs were added to these costs, and they were increased to compensate for failures. The profit margin is the publicly listed price of a drug, minus the estimated R&D costs for Switzerland and the production and distribution costs per unit.