No Transparency and No Consistency: Russia’s War Exposes the ‘Swiss Business Model’

Zurich, Lausanne, February 23, 2023

In May 2022, Public Eye’s factually detailed Gallery of Oligarchs revealed the magnitude and depth of the connections of the Putin-affiliated business elite with Switzerland. However, due to the lack of transparency of the financial hub, we still do not know what proportion of the assets held by sanctioned persons in Switzerland have been found and frozen. Moreover, the competent authorities are not showing any desire to actively search for them or to participate in internationally coordinated efforts. This is imperative, otherwise Switzerland cannot credibly engage in the international discussions on ways to confiscate assets of sanctioned individuals in accordance with the rule of law, and to use those to rebuild Ukraine. The war in Ukraine has further revealed how the same networks are used to launder assets of illegal origin and to circumvent sanctions. Thus, urgent action is needed to address the shortcomings in the Swiss provisions to prevent money laundering and financial crime.

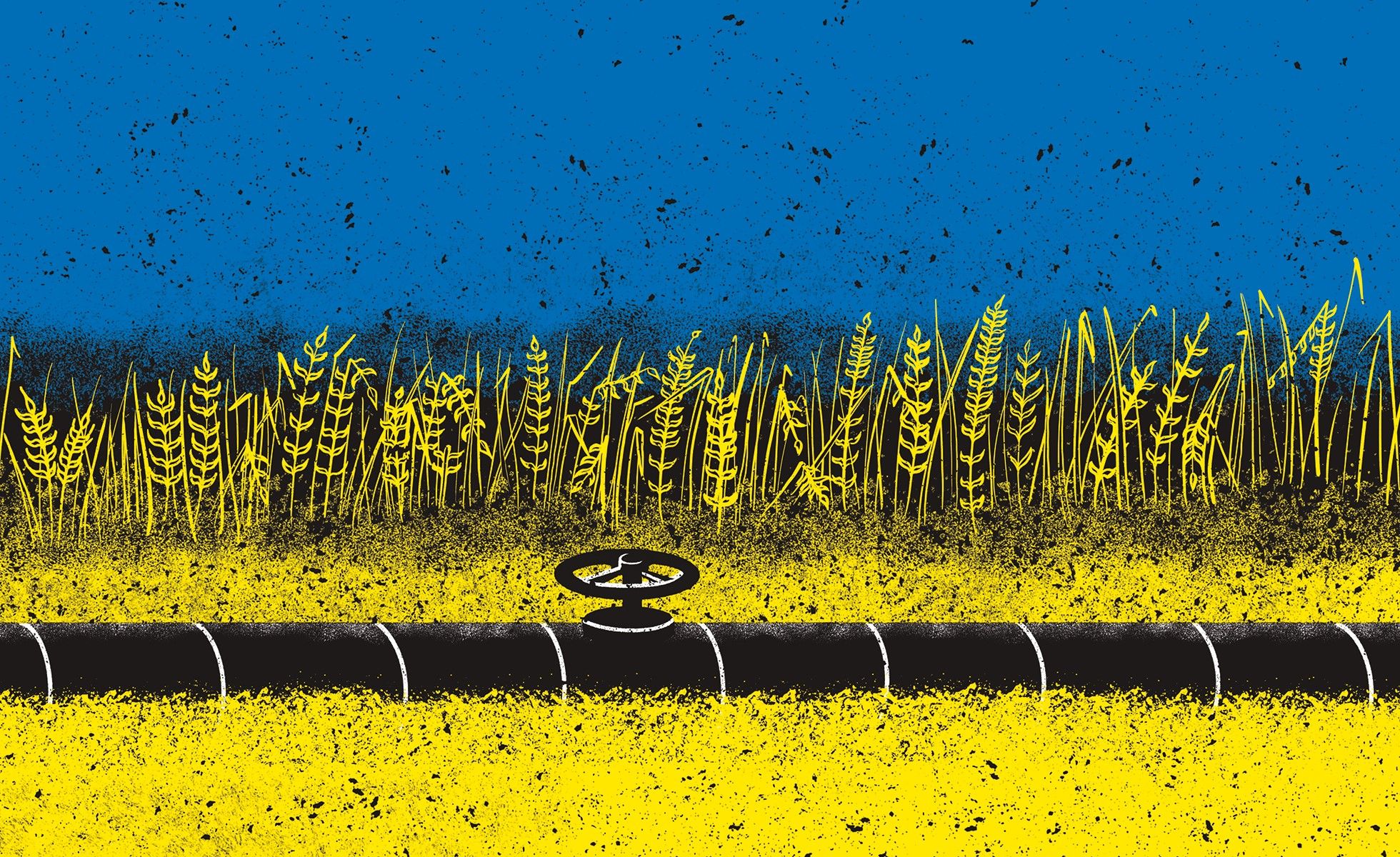

As well as the financial hub, the local commodity trading hub is also making a lucrative contribution to financing Russia’s war. In relation to last summer’s coal embargo, Public Eye research revealed that 75% of Russian coal exports are handled via Switzerland. However, the competent body, the State Secretariat for Economic Affairs (Seco), disposes of such insufficient information that any data-based policy and implementation of the sanctions is impossible. With the recent embargo on Russian oil, the main source of revenue for Putin’s state apparatus is now the focus of our research. Between 50 and 60% of Russian oil was traded in Switzerland at the start of the war: how quickly and rigorously Switzerland implements these new sanctions will prove to be an important gauge of its political credibility. This is another reason why Switzerland urgently needs a supervisory authority for the high-risk commodity trading sector, as it would ensure that the commodities traded in Geneva or Zug do not come from conflict zones or countries that are subject to international sanctions.

Moreover, the commodity trading hub itself has been benefitting hugely from the war and the resulting market fluctuations. In the first half of 2022, Swiss energy and agricultural traders all recorded record earnings on a historic scale. Instead of pampering Glencore, Cargill and the like with further privileges such as a ‘tonnage tax’, Switzerland should introduce an excess profit tax on their exorbitant crisis profits and ensure their equitable redistribution. The war in Ukraine and the sanctions against Russia have brought international attention to the risks and side effects of the business models of the Swiss financial and commodity hub. Public Eye shows the leverage available to Switzerland and its multinationals to limit the financing of ’Russia's war. However, even a year after the brutal invasion, there is still a lack of political will, as well as of the necessary data and legal bases to enable a consistent and effective implementation of the sanctions and regulation of commodity traders.

More information here or at:

Géraldine Viret, Media manager, +41 78 768 56 92, geraldine.viret@publiceye.ch

Robert Bachmann, Commodities and Finance Expert, +41 44 277 79 22, robert.bachmann@publiceye.ch