Crisis Profits by Commodity Traders: Why Switzerland Needs a Supervisory Authority and an Excess Profits Tax

Zurich, Lausanne, January 19, 2023

The greater the crises, the greater the volatility on the commodity markets and thus, the higher the profits of traders: indeed, the pandemic years of 2020 and 2021 were already extremely profitable for most Swiss-based traders. But in the first half of 2022, they even took it up a notch. Cargill, the world's biggest agricultural trader which manages its global grain trade from Geneva, generated a profit of USD 6.7 billion in the fiscal year from June 2021 to May 2022; an increase of 141% compared to their pre-pandemic average. Glencore in turn, which had recorded massive losses in 2020, increased its profits in 2021 by a colossal 661%. In the first half of 2022, the Zug-based group even beat this record figure by a tenfold increase in profit compared to the first six months of 2021, with USD 12 (!) billion. Public Eye's report on «War, Crises and Record Profits» not only shows the business figures of the ten largest commodity traders with headquarters or trading offices in Switzerland, but also who benefits from this enormous flood of money: a few commodity billionaires.

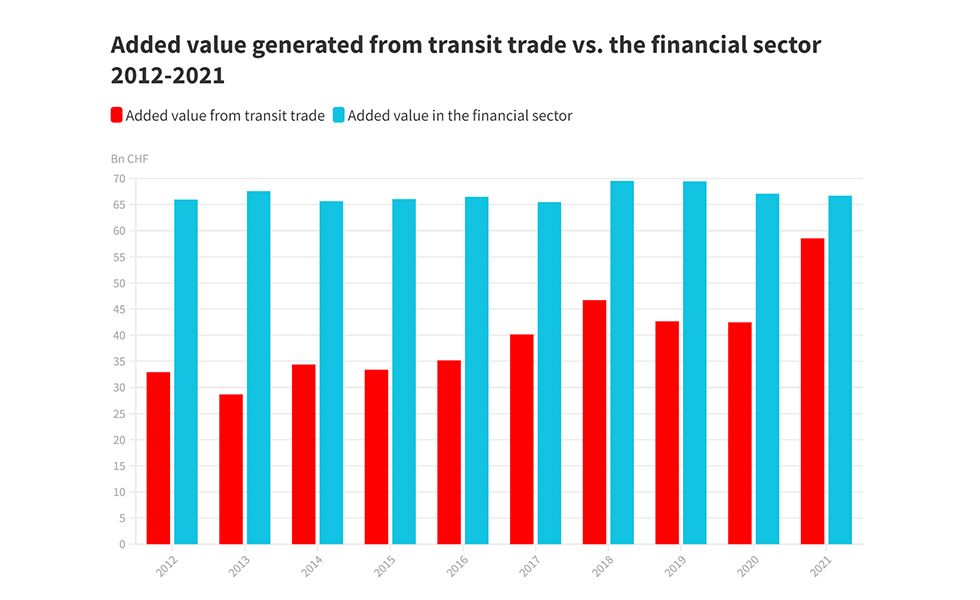

Economically, these record profits made by Cargill, Glencore and their competitors have led to a massive growth of this high-risk industry. According to statistics by the Swiss National Bank, the value generated by the sector in 2017 amounted to 25 billion Swiss francs, which, according to the Federal Council's 2018 Commodities Report, represented around 3.8% of gross domestic product (GDP). This figure has more than doubled since: In 2021, with 58.5 billion Swiss francs, commodity trading represents an incredible 8% of the GDP. In the private services sector, commodity trade is second only to the financial market (9.1% of GDP). The banks alone (without insurances, etc.) only accounted for 3.6% in 2020, generating not even half as much as the commodity trading hub. The Federal Administration, the media and even the industry association still refer to the 3.8% today. In light of the ground-breaking half-year figures of the traders against the background of the ongoing war in Ukraine, the industry’s GDP share will very likely be even higher in 2022.

As home state of this high-risk industry, Switzerland's responsibility also increases with the sector’s size, especially since the country systematically attracts these extremely profitable companies with its low-tax policy and lack of regulation. The equally risky financial sector has been subject to a financial market supervisory authority (FINMA) since 2007. A similar authority, including the necessary legal basis, to monitor the commodity trading sector is long overdue. Its growing economic weight, as well as countless wrongdoings, increasingly demonstrate the urgency for such commodity market supervision (Rohma). Moreover, the Swiss Federal Council and Parliament must ensure a fair redistribution of these excess profits, generated as a result of the pandemic and the war in Ukraine. Indeed, a tenfold increase in profits in a time of crisis, as in the case of Glencore, is clearly illegitimate. As a consequence, such as has already been introduced in the EU and various other countries, a special tax must be levied on crisis-related excess profits by energy and commodity companies based in Switzerland.

More information here or at

Oliver Classen, Media Director, +41 (0)44 277 79 06, oliver.classen@publiceye.ch

Silvie Lang, Soft Commodities Expert, +41 (0)44 277 79 10, silvie.lang@publiceye.ch