The Swiss coal map

Adrià Budry Carbó and Robert Bachmann, November 7, 2022

©

Frederick Florin/AFP via Getty Images

©

Frederick Florin/AFP via Getty Images

Switzerland closed its last coal mine 75 years ago, at the end of the Second World War. Nevertheless, in the 2000s it became a heavyweight in the international coal trade. It was no coincidence that the largest mining companies on the planet – be they Russian, US or Indian – lost no time in establishing a presence in Zug, Geneva and Ticino.

Two individuals well known to the trading world and the US Department of Justice are to be found at the genesis of the Swiss coal hub: Marc Rich and Ivan Glasenberg. Marc Rich was nicknamed the “godfather of oil” by the journalists at the financial news outlet Bloomberg – Javier Blas and Jack Farchy in their book The World for Sale1. He “shaped” the Swiss commodities hub by setting up in Zug in 1983, after fleeing the US judiciary, which was accusing him of tax evasion and of exploiting the Iranian oil embargo. So it was in Zug that the cigar-lover chose to set up the Marc Rich & Co. company. In April 19842, he hired a young but hardened South African trader with a clear idea in mind: coal had a brilliant future ahead of it. Together, Marc Rich and Ivan Glasenberg laid the first foundations of the future Swiss coal “hub”.

The “right guy” for the next stage

©

Jim Berry / Keystone / Camera Press

©

Jim Berry / Keystone / Camera Press

When Marc Rich & Co. acquired a stake in the company Xstrata in 1990, the latter was still called Südelektra and specialised in funding large electricity infrastructure projects in Latin America. Under the direction of its new majority shareholder, it used its listing on the stock market to raise funds on behalf of Marc Rich & Co., thus initiating its diversification into the mining sector.3

At the same time, Ivan Glasenberg was appointed as the head of the coal division at Marc Rich & Co. – which was renamed Glencore in 1994. For Marc Rich, there was no doubt that Ivan was “the guy who will basically take Glencore to its next stage”.4 From 1998, he drove the company to take on debt to acquire coal mines. Commodity prices were extremely low at the time, but this preceded a super-cycle, a sustained period of growing demand exceeding supply, that delighted the sector. The bet paid off. Up to this point, Glencore had been a pure trader. It then obtained secure access to tens of millions of tons of coal as well as the possibility to influence the price by adjusting production. In 2000, Glencore was already the world’s largest exporter of thermal coal; accounting for a sixth of global trade.5

But these companies’ fortunes were not always plain sailing. In 2002, when Glencore urgently needed liquidity, management devised a plan to set up two coal giants in Zug in the blink of an eye. Listed in London and Zurich, Xstrata sold USD 1.4 billion worth of shares to acquire Glencore’s Australian and South African coal mines. Marc Rich’s former company once again specialised in coal trading, now with production assured by Xstrata – of which he is also the main shareholder, with a 39 percent stake. Glencore retained its empire; Zug its coal hub.

Xstrata was finally absorbed by Glencore in 2013. The latter financed the operation by floating on the London Stock Exchange two years earlier. The company run by Ivan Glasenberg became the uncontested leader in coal. Its power was such that it attracted other companies into its slipstream and led smaller traders to follow a calling to a market that had appeared dead and (nearly) buried.

At the start of the 2000s, most international mining companies set up their commercial department and/or headquarters in Zug, Lugano or Geneva.

Dozens of traders, specialised in selling a commodity that had suddenly become global, swarmed around them. Switzerland became a hub for the international coal trade.

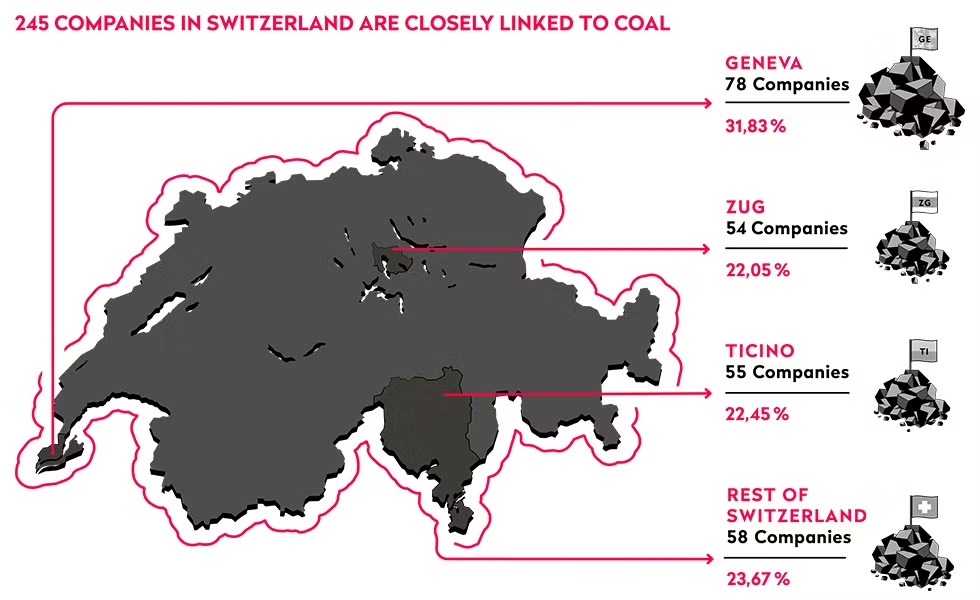

Public Eye counted 245 companies currently registered in Switzerland’s commercial register with the aim to market coal extracted from mines that they own, or have bought on the markets, or in Over-the-counter agreements; or providing financial services associated with coal or one of its derivatives. Their number in Zug is 54; in Ticino it is 55 and in Geneva it is 78.

-

Javier Blas & Jack Farchy, The World for Sale, Ed. Random House UK, 2021, pages 43 to 71.

-

Javier Blas & Jack Farchy, The World for Sale, Ed. Random House UK, 2021, page 182.

-

Javier Blas & Jack Farchy, The World for Sale, Ed. Random House UK, 2021, page 190.

-

Javier Blas & Jack Farchy, The World for Sale, Ed. Random House UK, 2021, page 183.

-

Javier Blas & Jack Farchy, The World for Sale, Ed. Random House UK, 2021, page 186–187.